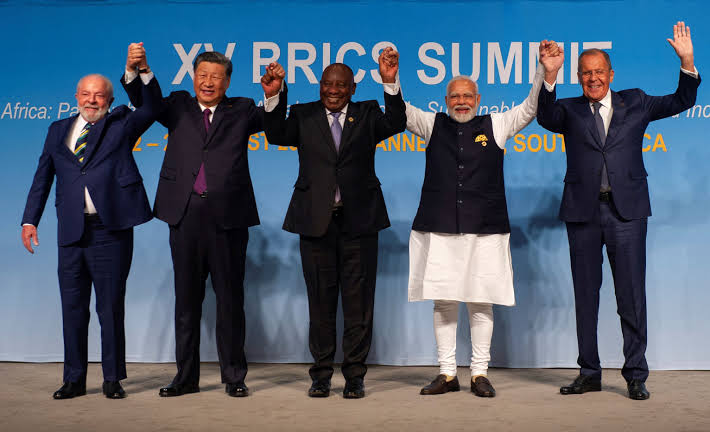

A BRICS BLITZ,

by Murad Jazy and Dr. Hikaru Kitabayashi.

July 24, 2023.

Part 1

Neoliberal capitalism under the garb of the Liberal World Order is a liar’s lair, where the common man, as a voter and consumer, is a potential asset and an exploitable victim. The global neoliberal order is a bad deal, something most people around the world have already experienced through the damage they have received from it. It is necessary now to move forward in developing the framework of a new, fair, and just multipolar international world order. They must also systematically create the theoretical and practical content, the tools and instruments that are necessary for theoretically independent nation-states to use in the process of reviving their sovereign mandates and powers, which were lost or diminished in recent decades as a result of the global neoliberal agenda.

In 2022 alone, central banks worldwide made record purchases of gold. This is a trend that was repeated in the first quarter of this year, according to research by asset manager Invesco. More importantly, in a world where traditionally many countries held their gold reserves in Fort Knox in the United States, the Invesco survey found that 68% of central banks now held part of their gold reserves domestically, up from 50% in 2020. The survey showed that that figure is expected to rise to 74% in five years.

Against this backdrop, the global demand for gold reached an 11-year high of 4,741 tonnes in 2022, up from 3,678 tonnes in 2020. According to the World Gold Council, this was driven by central bank purchases and heightened retail investor interest. Not only this, while physical gold has been in strong demand, gold ETFs (Exchange Traded Funds) have seen combined outflows of nearly 300 tonnes in 2021 and 2022. This is particularly important for countries attempting to decouple themselves from Washington’s financial blackmail, especially in view of the hundreds of billions of dollars in Russian assets that became unreachable abroad in 2022 after the crisis in Ukraine escalated into a proxy war between NATO and Russia.

The bloc [BRICS] is bigger than the entire G7, the European Union and the US combined in terms of population and production. With regard to any new BRICS currency, it is to be hoped that all the initial five countries of BRICS, along with any future members, should accept the obligation to use as central reserve deposited assets agreed on percentages of precious metals such as gold, silver and platinum or/and any precious gemstone, such as natural diamonds, in an electronic ledger in a fool proof manner. Blockchain technology could allow groups of finance and accounting experts, both official and unofficial, to monitor the system. One such official group with supervisory power could consist of a committee compromised an expert person from each and every member country having membership in such a system. Such a committee might be found desirable to exist for the sake of maintaining transparency in the physical verification, auditing, record keeping, etc. of such a system.

One such official group with supervisory power could consist of a committee compromised an expert person from each and every member country having membership in such a system. Such a committee might be found desirable to exist for the sake of maintaining transparency in the physical verification, auditing, record keeping, etc. of such a system.

Transparency is essential to trust-building and without trust, even a system backed by precious metals, will eventually collapse. It is, therefore, of the greatest importance that available data be verifiable and available to all, so that it can show the physical worth of a BRICS currency pegged to its current total value as a physical quantity of all the precious metals and other minerals held in the central reserve banks of the member countries.

Our Telegram channel.

Leave a comment